EdFest & Love The Fringe 2025 Performance Report

Comprehensive Analysis & Strategic Insights

Key Performance Indicators

Overview of the 2025 festival performance metrics

Total Revenue

Combined from EdFest & Love the Fringe (LTF)

Tickets Issued

Across all platforms and Scheme

LTF Memberships

Active Love the Fringe members

LTF Income

Net income from LTF memberships

The Times Giveaway

Total discount value £252,000

Contra value worth £32,000

Performance Overview

Strategic analysis of 2025 festival achievements and opportunities

Key Successes

Despite operating with a very small core team - Ross Nisbet part time at the start and then just Pete and Sophie for the core period this year delivered one of the most successful seasons on record, achieving a great improvement across both EdFest sales and Love the Fringe memberships.

The Times support was a significant improvement on 2024 and we still maintained a good presence in the Scotsman through header adverts in the pull out festival section, as well as The Herald.The Times are on board for 2026 and their aim is to increase their support from Scotland to National.

Affiliate sales were implemented effectively for the first time and this is an area that has good potential for growth, especially if STV can be brought on board.

This was achieved while maintaining a minimal staffing budget, demonstrating outstanding efficiency and effective resource management.The overall budget was significantly less than 2024 but achieved over 60% more.

The digital marketing strategy was robust and data-driven, with strong engagement and measurable results – see attached statistics.

Overall, what we accomplished with a reduced budget on 2024 was extraordinary a testament to strong collaboration, agility, and strategic focus. It demonstrates that if we can get this right the potential for the overall scheme to work is there, but it needs all related venues to collaborate more.

Areas for Improvement

Venue Support: Overall support from participating venues was limited. There was often a sense that engagement and collaboration had to be pushed from our side, rather than being embraced by the venues as part of their core purpose. In particular venues pushed their own websites to generate cash without also pushing joint sales through Edfest.com.

Love the Fringe Allocations: Ticket allocations were poorly managed by several venues with many only uploading allocations for the first week of the festival. This led to customer dissatisfaction and undermined the full benefit of membership offers. The number of free tickets used by LTF is still minimal compared to the actual number of comps issued by each venue.

Brand Presence and Staff Knowledge: Ticket allocations were poorly managed by several venues with many only uploading allocations for the first week of the festival. This led to customer dissatisfaction and undermined the full benefit of membership offers. The number of free tickets used by LTF is still minimal compared to the actual number of comps issued by each venue.

Promotional Material Handling: Only two venues collected and distributed Foemax inserts despite printed materials being supplied in full, leading to approximately £2,000 of wasted print stock. The Times inserts were also collected and distributed by only two venues, despite including content and promotions from across all venues.

Inconsistent Promotion: Some venues prioritised promoting the Half Price Hut over EdFest offers or Love the Fringe memberships, diluting the visibility and value proposition of our own brands.

Venue Engagement and Communication: There was limited proactive communication from most venues regarding campaign updates, allocation adjustments, or in-venue promotions, which made coordination more difficult and reduced campaign impact.

Improvements for 2026

Policy, ticketing, and marketing actions to tighten execution and drive full-price sales

Contract Clause: Ticket Offers & Free Tickets

Purpose: Keep Fringe Society focus on full-price revenue.

"The use of free or ticket offers is subject to approval by the venue, but can be managed by each show itself. Apart from the 2-for-1 days in the first week of the Festival, the aim is not to run free tickets* or Fringe Society offers in order to maintain focus on full-price sales. Offer activity should be managed via edfest.com, where companies can administer their own promotions."

- Owner: Venue & Contracts

- Action: Insert clause into 2026 visiting company contracts and venue pack.

- Deadline: By 31 January 2026

- *Data shows that papering ticket distribution was extremely high, yet fewer than 1% of those tickets were scanned at the venue. This indicates that free tickets were taken but not used, resulting in empty seats. In contrast, Love the Fringe free ticket allocations delivered a 98% attendance rate, demonstrating significantly higher engagement and genuine audience conversion.

Automated Payouts via Stripe*

Policy: Edfest.com to automatically release 90% of sales to venues on a rolling basis, with 10% retained until final reconciliation.

- Owner: Finance & Box Office

- Action: Configure Stripe Connect / payout schedule; add reporting dashboard for venues.

- Deadline: Go-live by 15 March 2026

- *Subject to development from red61 & venues to take responsibility for returns if anything is cancelled.

Joint Brochure: Feasibility & Plan

Rationale: Ongoing demand plus evidence from the 2025 Fringe Society survey indicates clear audience need.

- Owner: Marketing & Design

- Action: Scope format, print run, distribution, and co-funding model; present go/no-go and budget.

- Decision Gate: By 28 February 2026

- *Subject to Edfest venues discussion

Pre-Contract Marketing Pack for Visiting Companies

Objective: Show exactly what venues provide (esp. where there's a marketing charge) and emphasise that Edfest.com commission is only 3%.

- Owner: Marketing & Venue Relations

- Action: Distribute standardised initiatives deck and rate card before contract signature.

- Deadline: From 1 February 2026 (rolling)

Venue Marketing Commitments (Locked by March)

Requirement: Each venue to agree minimum support (channels, frequency, on-site placement) by end of March to ensure consistent delivery.

- Owner: Venue Leads

- Action: Sign off deliverables matrix (email, socials, on-site, PR hooks, Edfest placements).

- Deadline: 31 March 2026

Updated Venue Agreement (Edfest & Love the Fringe)

Plan: Issue refreshed agreement reflecting the above policies and timelines.

- Owner: Legal & Partnerships

- Action: Finalise terms, circulate, and collect signatures.

- Issue Date: End of February 2026

Love the Fringe: Hitting 2026 Budget & Giving Back

Goal: With full venue participation and the above processes, Love the Fringe can meet 2026 targets and begin returning support to the event.

- Owner: LTF Steering Group

- Action: Quarterly progress review on memberships, allocations, and venue activation.

- Checkpoints: Apr / Jun / Aug / Oct 2026

Key Dates at a Glance

- 31 Jan: Contract clause inserted

- 1 Feb → Marketing pack issued pre-contract

- 28 Feb: Joint brochure decision

- 15 Mar: Stripe payouts live (90% rolling)

- 31 Mar: Venue marketing commitments locked

- Mar: Updated venue agreement issued

- Apr/Jun/Aug/Oct: LTF quarterly reviews

Revenue Analytics

Comprehensive breakdown of revenue streams and performance

EdFest.com Sales Performance

Year-over-year comparison of ticket sales revenue

| Venue | Revenue (£) |

|---|---|

| Assembly | £19,260.75 |

| C Venues | £523.00 |

| Eiff | £0.00 |

| Gilded Balloon | £5,175.90 |

| Just the Tonic | £1,389.80 |

| PG | £1,005.00 |

| Pleasance | £14,823.05 |

| Summerhall | £0.00 |

| Underbelly | £12,449.10 |

| Zoo | £2,146.50 |

| Grand Total | £56,773.10 |

| Venue | Revenue (£) |

|---|---|

| Assembly | £36,672.73 |

| C Venues | £1,635.00 |

| Eiff | £42.00 |

| Gilded Balloon | £13,899.25 |

| Just the Tonic | £5,041.40 |

| PG | £1,268.50 |

| Pleasance | £31,400.55 |

| Summerhall | £4,831.50 |

| Underbelly | £19,928.15 |

| Zoo | £2,204.00 |

| Grand Total | £116,923.08 |

Exceptional Growth

EdFest.com sales increased by 106% year-over-year, from £56,773 to £116,923

Venue Expansion

All venues showed significant growth, with Assembly and Pleasance leading revenue increases

New Venue Success

Summerhall contributed £4,831 in its first year of participation

The Times × EdFest Media Partnership (2025)

National reach with Scottish depth, driving discovery, sales, and membership growth

Flagship media partnership with The Times / Times+ spanning print, digital, radio and social. The campaign anchored a 20,000-ticket Times+ giveaway, national press support, an 8-page Scottish editorial supplement, and integrated editorial mentions across Times platforms positioning EdFest.com as the primary ticketing destination.

Coverage window: 6 June – 25 August 2025

Times+ Members (UK)

High-intent cultural audience

Times+ Members (Scotland)

Regional depth for Fringe

Newsletter Engagement

Open rate / CTR (Times+)

Times+ Ticket Giveaway

- 20,000 free tickets to EdFest group shows (first five festival days).

- Single voucher code redeemable on edfest.com.

- Dedicated Times+ landing page: 6–30 June.

- 2× Times+ newsletter inclusions (~400k reach).

- Performance to be monitored for July top-up push.

Print (Scotland)

- 8-page editorial supplement (Times-produced):

- Cover: striking image + basement panel copy

- P2–3: Theatre - interviews + listings/highlights

- P4–5: Comedy - interviews + listings/highlights

- P6–7: Dance/Physical/Cabaret/Drag/Circus/Kids

- P8: Full-page EdFest advert

- Additional ads: 2× full-page

- 10× ¼ page (converted to 20× ⅛ page)

Digital, Social & Radio

- Times Live app / website editorial mentions alongside giveaway.

- Promoted social posts amplifying key content (incl. supplement).

- Times Radio live reads pushing Times+ ticket offer.

- Direct email to Times Scotland contacts.

- Explore “Picture of the Day” inclusion in The Times picture section.

| Metric | Value | Notes |

|---|---|---|

| Tickets Issued (Times+) | 16,947 | First five days of festival |

| Total Discount Value | £252,000 | Avg £14.87 per ticket |

| Contra Value | £32,000 | Media package given by Times for free |

| Newsletter Insertions | 2× | ~400k reach / 67% OR / 7% CTR |

| Coverage Window | 6 Jun – 25 Aug | Always-on presence through Festival |

Seat-Filling Without Diluting Brand

High redemption and strong occupancy lift across premium venues.

Editorial

Mentions adjacent to Times editorial improved trust and click-throughs to edfest.com.

2026 Momentum

The Times confirmed intent to scale from Scotland-led to UK-national support in 2026.

- Mention of giveaway alongside relevant EdFest editorial on Times Live/app.

- Explore weekly “best reviews” wrap with The List highlighting top Times-reviewed shows.

- Leverage Times Scotland Sunday editorial lead newsletter (~10,000) for EdFest content.

- Affiliate ticket sales via EdFest; cross-sell Love the Fringe memberships.

- Daily ticket offers (31 Jul – 25 Aug) only via paid advertising or newsletter promos.

- Venue marketing managers to offer Times ad packages direct to shows.

- edfest.com: add Times/Sunday Times subscription link and define media partner credits.

| Asset | Spec | Status / Dates |

|---|---|---|

| Editorial Supplement | 8 pages (cover + 3 feature sections + P8 ad) | Within 6 Jun – 25 Aug window |

| Press Adverts (UK) | Times+ house style | 2 insertions |

| Scottish Ads | 2× full pages | 1 in June - 1 in July |

| Scottish Ads (Alt.) | 10× ¼ page (or 20× ⅛ page) | Througout June to Aug |

Times × EdFest Launch Party

Date: Thu 5 June, 6:00pm

Venue: Tigerlily, Edinburgh

| Name | Role | Phone | |

|---|---|---|---|

| Carol Wyper | Head of Marketing | carol.wyper@news.co.uk | +44 7825 531 341 |

| Sarah Brophy | Marketing Manager | sarah.brophy@news-scotland.co.uk | +44 7500 123 976 |

| Ashley Davies | Supplement | ashley.r.davies@googlemail.com | — |

| Alex Macleod | Deputy Head of Sales | Alex.Macleod@news-scotland.co.uk | +44 7780 225 077 |

| Carla Jenkins | Social Media | — | — |

Times Ticket Giveaway Performance

Seat-filling partnership to boost occupancy across premium Fringe venues

| Metric | Value |

|---|---|

| Total discount value | £252,000 |

| Total tickets issued | 16,947 |

| Average discount per ticket | £14.87 |

| Venue | Tickets Issued |

|---|---|

| McEwan Hall | 646 |

| The Lafayette — Circus Hub | 589 |

| Palais du Variété | 439 |

| Gordon Aikman Theatre | 430 |

| Udderbelly (George Sq) | 405 |

| Total (Top Venues) | 2,509 |

| Show | Discount Value (£) |

|---|---|

| The Beauty (Circus Hub) | £8,990 |

| James Phelan — The Man Who Was Magic | £5,337 |

| FLIP Fabrique — Six° | £3,892 |

| Sophie's Surprise 29th | £3,186 |

| Bernie Dieter's Club Kabarett | £2,940 |

| Total (Top Shows) | £24,345 |

LTF Membership Analytics

Love the Fringe (LTF) membership performance and insights

| Tier | Fee (£) | Sold | Refunded | Net Sold | Gross Income (£) | Refunds (£) | Net Income (£) |

|---|---|---|---|---|---|---|---|

| Iron | 20 | 458 | 5 | 453 | 9,160 | 100 | 9,060 |

| Bronze | 50 | 330 | 4 | 326 | 16,500 | 200 | 16,300 |

| Silver | 100 | 127 | 2 | 125 | 12,700 | 200 | 12,500 |

| Gold | 500 | 4 | 0 | 4 | 2,000 | 0 | 2,000 |

| Platinum | 1,000 | 9 | 8 | 1 | 9,000 | 8,000 | 1,000 |

| Wowcher | 0 | 59 | 0 | 59 | 0 | 0 | 1,888 |

| TOTAL | 987 | 19 | 968 | 49,360 | 8,500 | 40,860 |

Digital Advertising Performance

Analysis of Google, Microsoft Ads, and paid social from April to September 2025

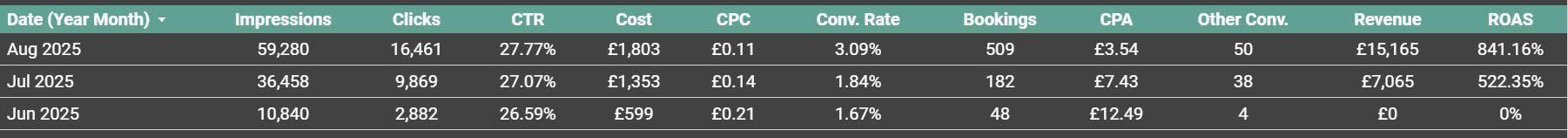

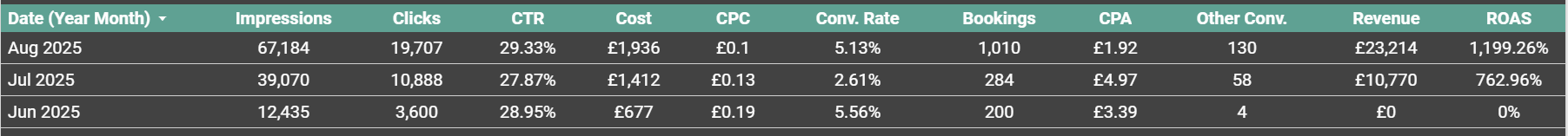

Between April 1 and September 2 2025, the EdFest digital campaigns delivered strong efficiency and conversion performance across Google, Microsoft Ads, and paid social.

PPC Performance by Month

Overall PPC Summary

Paid Social Performance

Overall PPC Results

| Metric | Value |

|---|---|

| Total impressions | 118,688 |

| Total clicks | 34,196 |

| Average CTR | 28.8% |

| Total cost | £4,025 |

| Average CPC | £0.12 |

| Total bookings / conversions | 1,494 |

| Average conversion rate | 4.37% |

| Cost per acquisition (CPA) | £2.69 |

| Other conversions (newsletter sign-ups etc.) | 192 |

| Attributed revenue | £33,984 |

| Overall ROAS | 844% |

Key Takeaways

Excellent Efficiency

£4,025 spend delivered £33,984 in tracked value — an 8.4× return

Peak Momentum

Festival-season ads in August delivered the highest CTR and ROAS

Brand Strength

Branded search far outperformed generic and P-Max campaigns

Regional Performance

Scotland outperformed England on click-through and ROAS